Analysis “Stranger Than Normal Wednesdays: Unlock the Secret of Put/Call Ratios

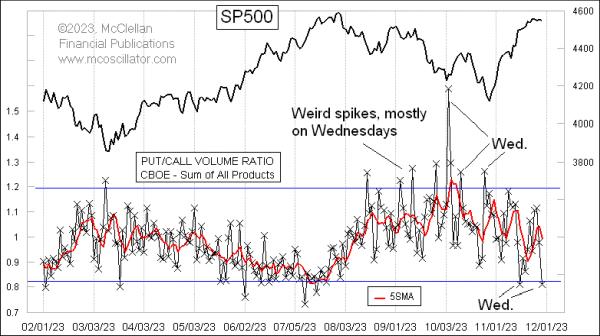

When it comes to understanding the stock market, there are many metrics and indicators that can help investors make informed decisions. One of these is the put/call ratio – commonly referred to as the PC ratio. The PC ratio is calculated by looking at the total number of put options divided by the total number of call options traded on a given day. Put options are the opposite of call options; the former represent the right to sell a stock while the latter represents the right to buy a stock.

The PC ratio can often be a useful indicator of investor sentiment. If the PC ratio is high – meaning there are more puts being purchased than calls – this can signal the market is bearish as more investors are betting on the stock’s downside. Conversely, if the PC ratio is low – meaning more calls are being bought than puts – this can signal an upcoming rally in the stock as more investors are betting on the stock’s upside.

It is important to note, however, that the PC ratio is not the only indicator investors should use. As such, some investors have turned to the practice of “Weird Wednesdays” to get a better reading on market sentiment. Weird Wednesdays is a term used to describe the practice of looking at the PC ratio on Wednesdays and comparing it with the previous Wednesday’s ratio. This provides a more accurate picture of the sentiment in the market as it eliminates any outliers caused by large option trading activity due to news events that may have occurred over the course of a week.

There are a few other ways an investor can utilize the PC ratio. One is to look at the ratio in relation to specific industries or stocks to spot potentially bearish and bullish setups. For example, if a particular industry or stock’s PC ratio suddenly rises, this could signal a shift in sentiment as more investors are buying puts on the stock. Alternatively, if a particular industry or stock’s PC ratio suddenly falls, this could signal a bullish sentiment as more investors are buying calls on the stock.

In conclusion, the put/call ratio is an important metric that can provide investors with valuable insight into market sentiment. Investors should be sure not to use the PC ratio in isolation, however, as it does not provide a comprehensive picture. As such, they can also look to the practice of “Weird Wednesdays” to get a better reading on the market and use the PC ratio in relation to specific stocks or industries to spot opportunities.

When it comes to understanding the stock market, there are many metrics and indicators that can help investors make informed decisions. One of these is the put/call ratio – commonly referred to as the PC ratio. The PC ratio is calculated by looking at the total number of put options divided by the total number of call options traded on a given day. Put options are the opposite of call options; the former represent the right to sell a stock while the latter represents the right to buy a stock.

The PC ratio can often be a useful indicator of investor sentiment. If the PC ratio is high – meaning there are more puts being purchased than calls – this can signal the market is bearish as more investors are betting on the stock’s downside. Conversely, if the PC ratio is low – meaning more calls are being bought than puts – this can signal an upcoming rally in the stock as more investors are betting on the stock’s upside.

It is important to note, however, that the PC ratio is not the only indicator investors should use. As such, some investors have turned to the practice of “Weird Wednesdays” to get a better reading on market sentiment. Weird Wednesdays is a term used to describe the practice of looking at the PC ratio on Wednesdays and comparing it with the previous Wednesday’s ratio. This provides a more accurate picture of the sentiment in the market as it eliminates any outliers caused by large option trading activity due to news events that may have occurred over the course of a week.

There are a few other ways an investor can utilize the PC ratio. One is to look at the ratio in relation to specific industries or stocks to spot potentially bearish and bullish setups. For example, if a particular industry or stock’s PC ratio suddenly rises, this could signal a shift in sentiment as more investors are buying puts on the stock. Alternatively, if a particular industry or stock’s PC ratio suddenly falls, this could signal a bullish sentiment as more investors are buying calls on the stock.

In conclusion, the put/call ratio is an important metric that can provide investors with valuable insight into market sentiment. Investors should be sure not to use the PC ratio in isolation, however, as it does not provide a comprehensive picture. As such, they can also look to the practice of “Weird Wednesdays” to get a better reading on the market and use the PC ratio in relation to specific stocks or industries to spot opportunities.