“Don’t Get Left Behind – Overbought Intermediate-Term Participation Levels Spell Weakness Long-Term

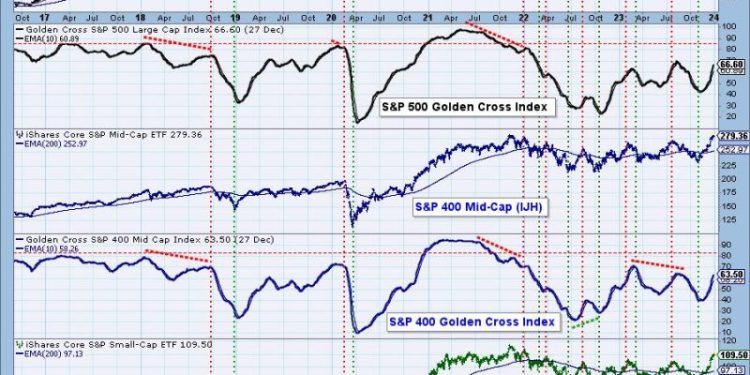

The markets have been on a roller coaster ride recently, and it’s been difficult to keep up with the current market movement. One noteworthy trend that has been observed is the extreme overbought levels of intermediate-term participation in the markets. These levels are very overbought and they are displaying some signs of weak long-term participation.

So what exactly is happening? In simple terms, intermediate-term participation refers to the buying and selling of stocks that are held for more than one year. This indicates the level of trading activity in the stock market and is often seen as a sign of the overall market sentiment. When this level is particularly high, it typically means that investors are bullish and believe that the market will eventually trend in a positive direction.

However, the current readings demonstrate that investor confidence is reaching extreme levels, as the intermediate-term participation levels have become extremely overbought. This suggests that the market may have reached an unsustainable level and could be due for a correction in the short term.

Furthermore, the weak levels of long-term participation indicate that further downside risk may be looming in the market. This is not exactly a sign of a healthy market. While investors may temporarily benefit from the strong short-term gains, there is a real risk of losses when these levels of overbought conditions become too high.

It is therefore important to keep an eye on these excessive levels of overbought participation, as it could have major implications for the overall market trend. In addition, investors should not forget that the long-term performance of the market is ultimately the most important measure for assessing the health of the market. Therefore, it is essential that investors remain vigilant and exercise caution when trading in the current market conditions.

The markets have been on a roller coaster ride recently, and it’s been difficult to keep up with the current market movement. One noteworthy trend that has been observed is the extreme overbought levels of intermediate-term participation in the markets. These levels are very overbought and they are displaying some signs of weak long-term participation.

So what exactly is happening? In simple terms, intermediate-term participation refers to the buying and selling of stocks that are held for more than one year. This indicates the level of trading activity in the stock market and is often seen as a sign of the overall market sentiment. When this level is particularly high, it typically means that investors are bullish and believe that the market will eventually trend in a positive direction.

However, the current readings demonstrate that investor confidence is reaching extreme levels, as the intermediate-term participation levels have become extremely overbought. This suggests that the market may have reached an unsustainable level and could be due for a correction in the short term.

Furthermore, the weak levels of long-term participation indicate that further downside risk may be looming in the market. This is not exactly a sign of a healthy market. While investors may temporarily benefit from the strong short-term gains, there is a real risk of losses when these levels of overbought conditions become too high.

It is therefore important to keep an eye on these excessive levels of overbought participation, as it could have major implications for the overall market trend. In addition, investors should not forget that the long-term performance of the market is ultimately the most important measure for assessing the health of the market. Therefore, it is essential that investors remain vigilant and exercise caution when trading in the current market conditions.