“Investors Surge Bitcoin Futures: Open Interest Soars!

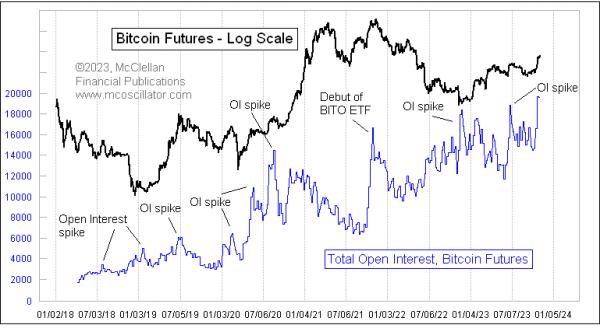

The recent surge in Bitcoin Futures Open Interest has sent ripples through the world of cryptocurrency trading. In the last week, more than $3 billion worth of Bitcoin Futures contracts were traded across multiple exchanges, prompting analysts to suggest that institutional and retail investors are setting their sights on Bitcoin once again.

Since its inception back in 2017, Bitcoin Futures have quickly become a popular way for traders to speculate on the future price of Bitcoin. By trading Bitcoin Futures, traders are able to purchase a contract for a specific price on a specific date, allowing them to speculate on Bitcoin’s future price direction without actually owning any of the asset. Additionally, because Bitcoin Futures are settled in Bitcoin, they offer a great way for traders to diversify their portfolio without taking on extra risk.

So why has this surge in Open Interest occurred? Primarily, the influx of institutional and retail investors has been driven by the improved understanding and acceptance of cryptocurrencies. As the underlying asset, Bitcoin, becomes more widely adopted and accepted as a form of digital money, more investors are viewing it as a great investment opportunity.

Furthermore, the increase in institutional trading suggests that many traditional financial institutions are now recognizing the potential of Bitcoin and its overall utility and are taking advantage of the opportunity to get involved. This could point to even greater gains in the future for Bitcoin as more institutional investors become involved.

Finally, the increase in Bitcoin Futures Open Interest is also being driven by the emergence of new trading products such as fixed tokens and options. These new products are designed to make investing in Bitcoin more accessible to retail investors and they offer an efficient and secure way to speculate on its future price without actually owning the underlying asset.

In conclusion, the surge in Bitcoin Futures Open Interest shows no sign of slowing down. As institutional and retail investors continue to recognize the potential of Bitcoin as an investment opportunity, expect to see more money flowing into this new asset class. With that said, it’s also important to remember that the risks associated with trading Bitcoin Futures remain and it’s advisable that traders are aware of them before entering the market.

The recent surge in Bitcoin Futures Open Interest has sent ripples through the world of cryptocurrency trading. In the last week, more than $3 billion worth of Bitcoin Futures contracts were traded across multiple exchanges, prompting analysts to suggest that institutional and retail investors are setting their sights on Bitcoin once again.

Since its inception back in 2017, Bitcoin Futures have quickly become a popular way for traders to speculate on the future price of Bitcoin. By trading Bitcoin Futures, traders are able to purchase a contract for a specific price on a specific date, allowing them to speculate on Bitcoin’s future price direction without actually owning any of the asset. Additionally, because Bitcoin Futures are settled in Bitcoin, they offer a great way for traders to diversify their portfolio without taking on extra risk.

So why has this surge in Open Interest occurred? Primarily, the influx of institutional and retail investors has been driven by the improved understanding and acceptance of cryptocurrencies. As the underlying asset, Bitcoin, becomes more widely adopted and accepted as a form of digital money, more investors are viewing it as a great investment opportunity.

Furthermore, the increase in institutional trading suggests that many traditional financial institutions are now recognizing the potential of Bitcoin and its overall utility and are taking advantage of the opportunity to get involved. This could point to even greater gains in the future for Bitcoin as more institutional investors become involved.

Finally, the increase in Bitcoin Futures Open Interest is also being driven by the emergence of new trading products such as fixed tokens and options. These new products are designed to make investing in Bitcoin more accessible to retail investors and they offer an efficient and secure way to speculate on its future price without actually owning the underlying asset.

In conclusion, the surge in Bitcoin Futures Open Interest shows no sign of slowing down. As institutional and retail investors continue to recognize the potential of Bitcoin as an investment opportunity, expect to see more money flowing into this new asset class. With that said, it’s also important to remember that the risks associated with trading Bitcoin Futures remain and it’s advisable that traders are aware of them before entering the market.