“Unlock Investment Profits With the McClellan Oscillator!

Investment-grade bonds are one of the most popular types of fixed-income investments because they are relatively safe and highly liquid. However, in order to truly maximize your returns, it is important to carefully examine the markets and identify potential opportunities. The McClellan Oscillator is one tool that can be used to do just this.

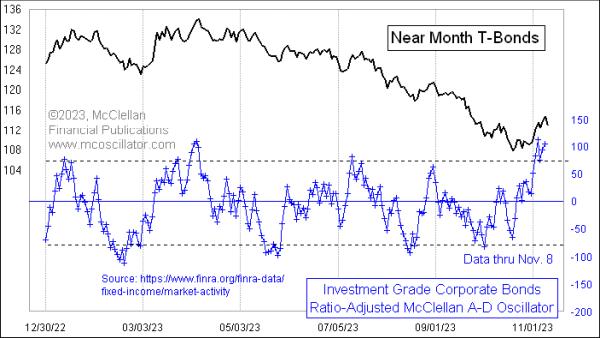

The McClellan Oscillator was developed by Sherman and Marian McClellan in the late 1960s. The Oscillator is a technical indicator that helps investors identify overbought and oversold conditions in the markets. It is a breadth indicator that combines advancing and declining stocks to measure the levels of buying and selling pressure in the markets. By combining these two metrics, the Oscillator is able to determine when the market is reaching an extreme state and can help investors identify entry and exit points for their investments.

To calculate the McClellan Oscillator, the number of advancing stocks are subtracted by the number of declining stocks. This number is then compared to a moving average of the stock in question over a particular period of time. The resultant number is then used to chart the Oscillator as a line graph. If the line is above zero, it is an indication that the stock is in an overbought condition. If the line is below zero, then it is an indication that the stock is oversold.

The McClellan Oscillator can be used to identify upside and downside opportunities on the investment-grade bond market. By studying the markets and plotting the Oscillator’s line graph, it is possible to identify extreme conditions in the markets. By doing this, investors can then identify entry and exit points for their investments.

Investment-grade bonds can be a great way to supplement your income and build a diversified portfolio. However, it is important to carefully examine the markets and identify potential opportunities. The McClellan Oscillator can be used as one tool to help you do this. By studying the markets and plotting the Oscillator’s line graph, you can identify entry and exit points for your investments and maximize your returns.

Investment-grade bonds are one of the most popular types of fixed-income investments because they are relatively safe and highly liquid. However, in order to truly maximize your returns, it is important to carefully examine the markets and identify potential opportunities. The McClellan Oscillator is one tool that can be used to do just this.

The McClellan Oscillator was developed by Sherman and Marian McClellan in the late 1960s. The Oscillator is a technical indicator that helps investors identify overbought and oversold conditions in the markets. It is a breadth indicator that combines advancing and declining stocks to measure the levels of buying and selling pressure in the markets. By combining these two metrics, the Oscillator is able to determine when the market is reaching an extreme state and can help investors identify entry and exit points for their investments.

To calculate the McClellan Oscillator, the number of advancing stocks are subtracted by the number of declining stocks. This number is then compared to a moving average of the stock in question over a particular period of time. The resultant number is then used to chart the Oscillator as a line graph. If the line is above zero, it is an indication that the stock is in an overbought condition. If the line is below zero, then it is an indication that the stock is oversold.

The McClellan Oscillator can be used to identify upside and downside opportunities on the investment-grade bond market. By studying the markets and plotting the Oscillator’s line graph, it is possible to identify extreme conditions in the markets. By doing this, investors can then identify entry and exit points for their investments.

Investment-grade bonds can be a great way to supplement your income and build a diversified portfolio. However, it is important to carefully examine the markets and identify potential opportunities. The McClellan Oscillator can be used as one tool to help you do this. By studying the markets and plotting the Oscillator’s line graph, you can identify entry and exit points for your investments and maximize your returns.