“Uncertainty Sparked by OPEC’s Oil Cuts – What Lies Ahead?

In recent months, the Organization of the Petroleum Exporting Countries (OPEC) has implemented an unprecedented series of oil production cuts in an effort to stabilize global crude oil prices. These cuts were largely applauded by the international community as a necessary step to help weather the economic downturn caused by the Covid-19 pandemic. However, there is a growing sense of skepticism surrounding OPEC’s commitment to the promises it made.

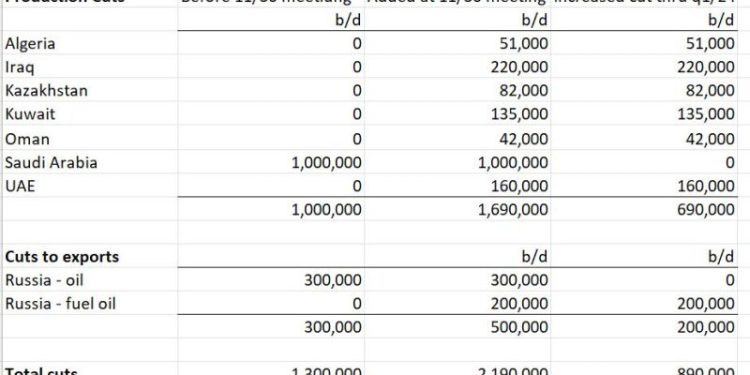

The alliance of oil-producing nations, led by Saudi Arabia, promised to cut 9.7 million barrels of oil every day by the end of the first quarter of 2021. This pledge was intended to keep prices from dropping too low and help stabilize global energy markets.

Unfortunately, the promised cuts have yet to materialize. OPEC’s latest report states that the daily production cuts have only reached approximately 7.4 million barrels per day. This figure leaves 1.3 million barrels per day unaccounted for, weakening OPEC’s standing among the global oil community.

This skepticism is further intensified by the fact that the OPEC+ countries have already started opening up their outputs in spite of an uneven economic recovery in global demand for oil. Saudi Arabia and Russia, two of the most influential countries in OPEC, have already increased their daily production by 300,000 and 400,000 barrels per day respectively.

Critics of the decision claim that this move is motivated by a desire to increase short-term profits rather than fulfill the long-term goals of stabilizing the global economy. They argue that, far from helping the economic recovery process, these actions will only serve to further destabilize the already volatile global energy markets.

The lack of trust in OPEC’s plans has spilled over, affecting the confidence that many other investors and nations have in the global energy market. Many investors have begun to shift their focus away from oil, instead investing their resources in other areas of the economy.

While OPEC continues to work to restore faith in its commitment to global energy market, it is clear that its pledge to help the economy weather the pandemic has not been as successful as initially hoped. Until more concrete steps are taken to fulfill the initial promises made, skepticism over OPEC’s plan will remain, along with little faith in the stability of the global oil market.

In recent months, the Organization of the Petroleum Exporting Countries (OPEC) has implemented an unprecedented series of oil production cuts in an effort to stabilize global crude oil prices. These cuts were largely applauded by the international community as a necessary step to help weather the economic downturn caused by the Covid-19 pandemic. However, there is a growing sense of skepticism surrounding OPEC’s commitment to the promises it made.

The alliance of oil-producing nations, led by Saudi Arabia, promised to cut 9.7 million barrels of oil every day by the end of the first quarter of 2021. This pledge was intended to keep prices from dropping too low and help stabilize global energy markets.

Unfortunately, the promised cuts have yet to materialize. OPEC’s latest report states that the daily production cuts have only reached approximately 7.4 million barrels per day. This figure leaves 1.3 million barrels per day unaccounted for, weakening OPEC’s standing among the global oil community.

This skepticism is further intensified by the fact that the OPEC+ countries have already started opening up their outputs in spite of an uneven economic recovery in global demand for oil. Saudi Arabia and Russia, two of the most influential countries in OPEC, have already increased their daily production by 300,000 and 400,000 barrels per day respectively.

Critics of the decision claim that this move is motivated by a desire to increase short-term profits rather than fulfill the long-term goals of stabilizing the global economy. They argue that, far from helping the economic recovery process, these actions will only serve to further destabilize the already volatile global energy markets.

The lack of trust in OPEC’s plans has spilled over, affecting the confidence that many other investors and nations have in the global energy market. Many investors have begun to shift their focus away from oil, instead investing their resources in other areas of the economy.

While OPEC continues to work to restore faith in its commitment to global energy market, it is clear that its pledge to help the economy weather the pandemic has not been as successful as initially hoped. Until more concrete steps are taken to fulfill the initial promises made, skepticism over OPEC’s plan will remain, along with little faith in the stability of the global oil market.